1099-NEC Simplified: Filing Requirements & Tax Compliance for the Upcoming Season

Navigating income taxes can be tricky. This is especially true for small business owners that hire independent contractors. Companies must report payments to freelancers and self-employed professionals each tax season. They do this using Form 1099 NEC. If you are confused about how it works, this guide is here to help. It will cover everything, such as the differences between 1099 NEC and 1099 MISC, IRS rules, filing requirements, and mistakes to avoid. Whether you are a business owner or a contractor, knowing how to manage 1099 tax forms correctly will make tax season easier. It will also help you stay compliant.

Key Highlights

What is IRS Form 1099 NEC? It is a tax form from the IRS. This form is used to report payments to independent contractors. It applies when they receive $600 or more in a tax year.

1099 NEC vs. 1099 MISC: The 1099 NEC is for non-employee payments. The 1099-MISC form covers other types of payments, like rent and royalties.

Filing Requirements: Businesses must send out 1099 NEC for payments of $600 or more to independent contractors. This does not apply to corporations or payments made by credit card.

How to File: Gather the contractor’s information, like their Tax Identification Number (TIN) and how much they were paid. Then, submit the form by January 31. E-filing is best to reduce mistakes and speed up the process.

Late Filing Penalties: If you don’t file on time, you may have to pay a fine. The penalty can be between $50 and $580 for each form, based on how late you file.

What does Form 1099-NEC represent?

Filing Form 1099-NEC electronically can speed up the process and reduce errors.

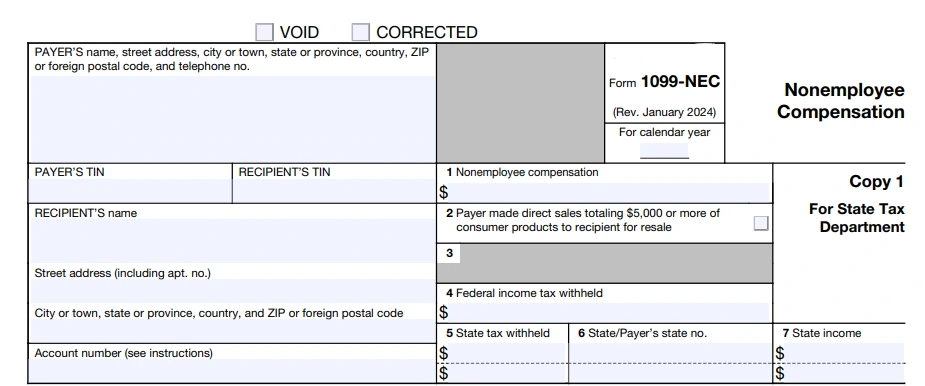

1099-NEC is a tax form from the IRS. Businesses use this IRS form to report payments to independent contractors for work done in a calendar year. This form is essential for being transparent with the IRS about payments that are not for employees. It also helps businesses know their federal income tax responsibilities. Before, these payments were reported in Box 7 of Form 1099-MISC.

If a business pays an independent contractor $600 or more in a tax year, it must file 1099 NEC with the IRS. The company must also give a copy to the contractor. This form has important information. It includes the taxpayer identification number (TIN) of the payer and the contractor, the total amount paid, and any federal income tax withheld.

Grasping the Basics of Form 1099-NEC

The IRS uses 1099 NEC to keep track of payments made to independent contractors. This form helps ensure that contractors report their income accurately. Following IRS rules for 1099 NEC is essential. Accurate reporting is crucial because it helps keep taxes fair, increases financial transparency, and supports vital government services.

The Role of 1099 NEC in Tax Reporting for Independent Contractors

1099 NEC is important for the Internal Revenue Service (IRS). It helps the IRS track the income that independent contractors and businesses earn. This form keeps a record of payments made to these contractors. It also allows the IRS to check this information against the contractor’s tax return.

Filing 1099 tax forms the right way is significant for businesses. It helps them follow the rules and avoid fines from the IRS. When businesses report payments for non-employee work correctly, it makes sure that they are appropriately noted and taxed fairly. The IRS makes companies report these payments to support tax rules. This helps fund public services, which are necessary for everyone.

What does Non-employee Compensation mean?

Non-employee compensation means paying freelancers, self-employed people, and independent contractors for their work. Regular employees get a Form W-2 that shows income tax, Social Security, and Medicare taxes taken out. In contrast, independent contractors take care of these taxes on their own.

Since businesses do not take out payroll taxes from payments to contractors, they must use 1099-NEC. This form shows the total amount paid during the tax year. It helps contractors determine how much they owe when filing their federal income tax returns.

If you are an independent contractor or freelancer seeking guidance on using the 1099-NEC form, check out this detailed blog on independent contractor taxes.

1099-NEC and 1099-MISC – Main Distinctions

Before 2020, businesses used Form 1099-MISC to report payments to people who were not employees. But now, with the new Form 1099-NEC, things have changed. The 1099-MISC is used for miscellaneous income. In contrast, the 1099-NEC is just for payments made to independent contractors.

Comparing 1099-NEC vs 1099-MISC

Aspect | 1099-NEC | 1099-MISC |

Purpose | Reports non-employee compensation | Reports miscellaneous income |

Examples | Payments to freelancers, independent contractors | Rents, royalties, prizes, awards, fishing boat proceeds |

Both are subject to backup withholding. This means businesses might have to keep back federal income tax if the payee does not give a valid taxpayer identification number (TIN).

Determining Who Is Required to Submit 1099 NEC

Your business paid $600 or more to non-employees, such as freelancers or contractors.

You paid someone for services, rents, or prizes and awards.

You have a partnership or an LLC, which are considered separate tax entities.

You paid someone who is not your employee.

The payment is for services that relate to your business.

You paid an independent contractor $600 or more in the tax year for work done for your business.

You withheld taxes from payments to nonemployees based on backup withholding rules.

You made direct sales of $5,000 or more in consumer products for resale.

There are some exceptions to be aware of. You do not need to use 1099-NEC for payments to corporations. It also does not apply to credit card transactions or personal service fees. To better understand what you need to file, check the IRS rules for 1099-NEC or talk to a tax expert.

Requirements for Businesses to Provide 1099 NEC

Many small businesses work with freelancers. So, it is essential to know the 1099 NEC rules. To give a 1099-NEC, the contractors must be independent workers. You must also have paid them at least $600 in the tax year. This rule applies to individuals, partnerships, or single-member LLCs. Ensure you get a Form W-9 from the contractor before paying them. This form has important details, like the contractor’s name, address, and Taxpayer Identification Number (TIN).

Common Misconceptions About Filing Requirements

A common misunderstanding is that you must file Form 1099 NEC only if you held back taxes from the contractor’s payments. However, the filing rule depends on the total amount paid, not if taxes were withheld.

Another mistake is believing businesses can submit the 1099-NEC form by the usual tax filing deadline. The deadline for filing information returns, like the 1099-NEC, is usually January 31. If January 31st lands on a weekend or a holiday, the due date moves to the next business day.

Submitting Form 1099-NEC

Filing Form 1099-NEC is easy. First, gather all the essential details. You need your business TIN, the contractor’s TIN from their W-9 form, and the total payment you made to the contractor at the end of the tax year.

Next, you must choose whether to file electronically using the IRS Filing Information Returns Electronically (FIRE) System or paper forms from the IRS. Register with the FIRE system before you start if you decide to file electronically. You can also file information returns for the tax year 2022 and later with the Information Returns Intake System (IRIS). This system lets you make corrections and ask for automatic extensions.

Starting in Tax Year (TY) 2023, if a business has 10 or more information returns, it must file them electronically.

Ready to Submit: Required Documents and Information

Before you file, make sure you have all the needed documents. Gather your business TIN, the contractor’s TIN from their W-9 form, and all the payment details for the tax year. It’s essential to complete the W-9 form. This helps you verify the contractor’s TIN and check if they are exempt from backup withholding.

Tracking all payments made to contractors who are not employees is very important. It helps you get the correct information for 1099 NEC reporting. You will need this info to report income on the contractor’s tax return. Also, 1099 NEC assists you with filling out Schedule C when you file your Form 1040. This shows how much profit or loss your business has.

Electronic Filing vs. Paper Filing: Advantages and Disadvantages

Your decision on how to file depends on how many forms you have. Electronic filing is fast and works well. It is a good option for businesses that handle many forms. This method lowers the chances of mistakes and lets you submit online easily.

Paper filing works well for small businesses that have fewer forms to send. It requires you to pay close attention to details. You have to mail them on time to meet deadlines. If you are filing on paper, don’t forget to add Form 1096 as a summary with your submission.

Here’s a quick comparison:

Electronic Filing: It is faster, has fewer mistakes, and is easy to submit online.

Paper Filing: It needs you to send it physically. There is a greater chance for errors and delays. This method is best for a small number of forms.

User: Make sure to be accurate and meet the filing deadline, no matter how you file.

1099-NEC Filing Deadlines and Penalties

You need to send Copy A of Form 1099 NEC to the IRS. Then, send Copy B to the payees. The regular filing deadline is January 31. This deadline is for payments that were made in the prior year. If you do not file 1099 NEC on time or if there are mistakes, you might face penalties from the IRS. These fines depend on how late the filing is and if there are any unpaid taxes. Penalties for filing late can range from $50 to $580 for each form. If you do not comply and it is on purpose, the fines can be even higher.

Not following the filing rules could get the IRS’s attention and lead to an audit. If businesses intentionally ignore their tax obligations, they might face legal issues for not paying taxes correctly. To avoid these problems, knowing your responsibilities about contractor payments, backup withholding, and filing Form 1099 NEC is essential.

W-9 Form and Additional Documents Required for Collaborating with Independent Contractors

Before paying independent contractors, businesses need to get Form W-9. This form gathers details like the contractor’s name, address, and Taxpayer Identification Number (TIN). This TIN can be their Social Security Number (SSN) or Employer Identification Number (EIN). Getting this form helps report nonemployee payments accurately to the IRS. It also allows the Social Security Administration (SSA) to monitor Social Security and Medicare contributions. This way, businesses can avoid issues with backup withholding.

In addition to 1099 NEC, you might have to file other 1099 tax forms. This depends on your payment type and where the contractor is located. For example, if you make direct sales of $5,000 or more, you could need to file 1099-MISC. Each state has different tax laws. So, talking to your state tax department ensures you follow the state income tax rules.

Conclusion

Understanding Form 1099-NEC is essential for easy tax reporting. This is used to report compensation payments to non-employees. It helps you follow tax rules. Knowing who must file 1099-NEC and how it differs from 1099-MISC is good. Pay attention to filing deadlines and penalties for late submissions of 1099-NEC. To make your tax process more manageable, gather all the needed documents. Think about the benefits of filing electronically for faster and more precise submission.

How Can ForMyTax Help?

ForMyTax can assist you in navigating the complexities of tax reporting, specifically Form 1099-NEC. By leveraging their bookkeeping services, you can ensure accurate reporting of nonemployee compensation payments and avoid penalties for late submissions. Their expertise can streamline your tax process, organize your financial records, and facilitate faster, more precise submissions. Stay informed about 1099-NEC with ForMyTax to easily handle the upcoming tax season.

Frequently Asked Questions

If you find a mistake on your 1099-NEC after the due date, you must file an amendment with the IRS. Fix any wrong details, like the taxpayer identification number (TIN) or payment amount. After making these changes, send the updated form to the IRS and the contractor.

No, Form 1099-NEC is typically not used for international contractors. Instead, use Form 1042-S for reporting non-employee compensation paid to foreign individuals or businesses. Be sure to check tax treaty provisions for specific requirements.

If you’re a freelancer or independent contractor, the income reported on Form 1099-NEC must be included on your tax return. It is generally reported on Schedule C and may be subject to self-employment taxes, including Social Security and Medicare.

Businesses must submit Form 1099-NEC if they paid $600 or more to non-employees, such as freelancers, contractors, or service providers. This applies to individuals, partnerships, and LLCs, but does not apply to corporations (except for legal services).

As an independent contractor, you’ll receive a Form 1099-NEC if you earned $600 or more from a client during the tax year. This form reports non-employee compensation and helps you calculate how much federal income tax you need to pay.

If you receive both a 1099-NEC and a W-2, you need to report both forms on your tax return. The 1099-NEC shows income from freelance or contract work, while the W-2 reports income from employment. Be sure to include self-employment taxes for your 1099-NEC income.

The due date for submitting Form 1099-NEC to the IRS is January 31 of the tax year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Make sure to submit by this date to avoid penalties.

If a business misses the Form 1099-NEC filing deadline, the IRS may impose penalties. These fines range from $50 to $580 per form, depending on how late the filing is. Delays can also result in further scrutiny and potential audits, so it’s crucial to file on time.

You must issue a 1099-NEC to independent contractors if you paid them $600 or more for services provided during the tax year. This includes individuals, partnerships, and LLCs. However, payments to corporations generally don’t require a 1099-NEC unless for legal services.

You need to issue a 1099-NEC if your business makes direct sales of $5,000 or more in consumer products for resale. For example, if you sell goods like cosmetics to an independent distributor, this threshold applies, and the 1099-NEC should be filed.

To file Form 1099-NEC online, you can use IRS-approved e-filing services or tax software. Gather all necessary information, such as the contractor’s details and payment amounts, and submit electronically. E-filing is fast, accurate, and helps you meet deadlines efficiently.

Freelancers do not need to submit Form 1099-NEC themselves. However, if they earn $600 or more from a client during the tax year, they will receive this form from the client. Freelancers must report this income on their tax returns.

The IRS deadline for filing Form 1099-NEC for the 2024 tax year is January 31, 2025. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It’s important to submit by this date to avoid penalties.

Popular Blogs

W9 Form: Request for Taxpayer Identification Number – Know What is a Form W-9, Who Needs It and How to Fill It Out

W9 Form: Request for Taxpayer Identification Number – Know What is a Form W-9, Who Needs It and How to Fill It OutNavigating IRS tax forms can be difficult. This is true…

Read More » Beginner’s Guide to Self-Directed IRA Rules and Regulations: Exploring Investment Options and Custodians

Beginner’s Guide to Self-Directed IRA Rules and Regulations: Exploring Investment Options and CustodiansAre you looking for ways to grow your retirement savings…

Read More » What Is APR: Types & Calculation Simplified

What Is APR: Types & Calculation SimplifiedWhen looking for a business loan, understanding APR (Annual Percentage Rate) is…

Read More » Contacting the IRS: To Receive Help, Call IRS Customer Service and Speak With an Agent

Contacting the IRS: To Receive Help, Call IRS Customer Service and Speak With an AgentNavigating the tax system can be overwhelming, but connecting with…

Read More » Unlocking the Importance of Accounting for Business Growth: Navigating Financial Success

Unlocking the Importance of Accounting for Business Growth: Navigating Financial SuccessAccounting is crucial for business success, influencing key decisions and…

Read More » Income Statement Explained: Meaning, Importance, and Examples for Your Business Success

Income Statement Explained: Meaning, Importance, and Examples for Your Business SuccessWondering how an income statement can help you track your…

Read More » Demystifying Liabilities in Financial Accounting: A Guide to Liabilities Definition, Categories, Examples, Ratios

Demystifying Liabilities in Financial Accounting: A Guide to Liabilities Definition, Categories, Examples, RatiosIn financial accounting, it is important to understand financial statements.…

Read More »

Related Blogs

Navigating IRS tax forms can be difficult. This is true if you don’t know much about the different types and what they

Navigating income taxes can be tricky. This is especially true for small business owners that hire independent contractors. Companies must report payments

Are you looking for ways to grow your retirement savings and increase your financial future? A Self-Directed IRA (SDIRA) might be the

When looking for a business loan, understanding APR (Annual Percentage Rate) is essential. It shows the full cost of borrowing, factoring in the interest

Navigating the tax system can be overwhelming, but connecting with IRS customer service can help clear up any confusion. Whether you need

Accounting is crucial for business success, influencing key decisions and driving profitability. Understanding the importance of accounting in organizations helps business owners

Wondering how an income statement can help you track your business’s financial health? This essential financial statement gives you a clear picture

In financial accounting, it is important to understand financial statements. A major part of this is about liabilities. They are the debts

In business, it is very important to know how your company is doing financially. Year-over-year (YOY) growth analysis is a key performance

Picture this: you’re sitting down to do your taxes, and you’ve got your Form W-2 in front of you. But then you

FORMYTAX.COM

Providing quick and personalized support is our mission. Our U.S. based support team is committed to providing excellent service in every time zone. We're always willing to help!

SUPPORT

- support@formytax.com

- (888) 808-4641

-

2400 Barranca Pky, Irvine, CA 92606

14341 Clark Avenue, Bellflower, CA 90706.