W9 Form: Request for Taxpayer Identification Number – Know What is a Form W-9, Who Needs It and How to Fill It Out

Navigating IRS tax forms can be difficult. This is true if you don’t know much about the different types and what they are for. A form that often confuses people is the W9, known as the ‘Request for Taxpayer Identification Number and Certification.’

The Form W-9 matters for anyone who gets or pays income. It helps check a person’s taxpayer identification number (TIN). This could be their Social Security Number (SSN) or Employer Identification Number (EIN). Knowing how to use the form and fill it out correctly can help you avoid issues with income tax. Continue reading to make filing your 2025 taxes easier.

Key Highlights

The W-9 form collects taxpayer identification numbers from individuals and businesses.

It helps businesses and banks follow IRS rules.

A W-9 form is used when someone needs to report payments made to you for tax reasons.

It is important to provide accurate information on your W-9 to avoid tax problems.

You do not send this form to the IRS; you keep it for your records.

What is a W9 form?

IRS Form W-9 is known as the “Request for Taxpayer Identification Number and Certification“. People and businesses use this form to provide others with their correct taxpayer identification number (TIN). This includes individuals, businesses, banks, and financial institutions that require it for tax reporting.

The W-9 is not like other tax forms that you send to the IRS. You don’t send it to the IRS at all. Instead, you provide it to the person or business who asked for it. They will store it for their records so they can report the right payments made to you. This information helps them prepare other tax forms, such as 1099, which they may need to file with the IRS.

Understanding the Importance of IRS Form W9

The Form W-9 is key for reporting taxes correctly. When you give your TIN, it helps people who pay you report what they paid you. This can help prevent errors and avoid fines from the IRS.

If you don’t provide a W-9 form when asked, it can lead to problems. Businesses are required to withhold taxes on payments made to individuals or companies that do not send in a W-9 form.

The primary purpose of Form W-9

The main goal of Form W-9 is to provide your taxpayer identification number, known as TIN, to the requester. The TIN is a nine-digit number given by the IRS. It helps the IRS accurately identify taxpayers. This number is crucial because it allows the payer to fulfill their tax reporting responsibilities to the IRS.

Remember that W-9 is an “information return.” This means it shares information with another person or group, not directly with the IRS. When a payer, such as a business or a bank, requests a W-9 from you, they intend to report some financial transactions to the IRS. W-9s are also used in real estate transactions. Buyers and sellers need to share these forms, especially when rental income or property sales are involved.

The details you give on the W-9 help the payer send the right information return, like Form 1099, for that tax year. By completing the W-9, you show your identity and tax status to the payer. This helps both you and the payer report taxes correctly.

Who is required to fill out Form W-9?

If you are an individual taxpayer, you must fill out a W-9 if you work as an independent contractor, freelancer, or consultant. This is necessary when you earn over $600 from one client in a tax year.

Businesses like corporations, partnerships, and LLCs also need to complete a W-9. This can happen when they get paid for services, rent buildings, or earn money like interest or dividends above certain limits.

In short, anyone making money that is not subject to regular employee withholding must provide a W-9.

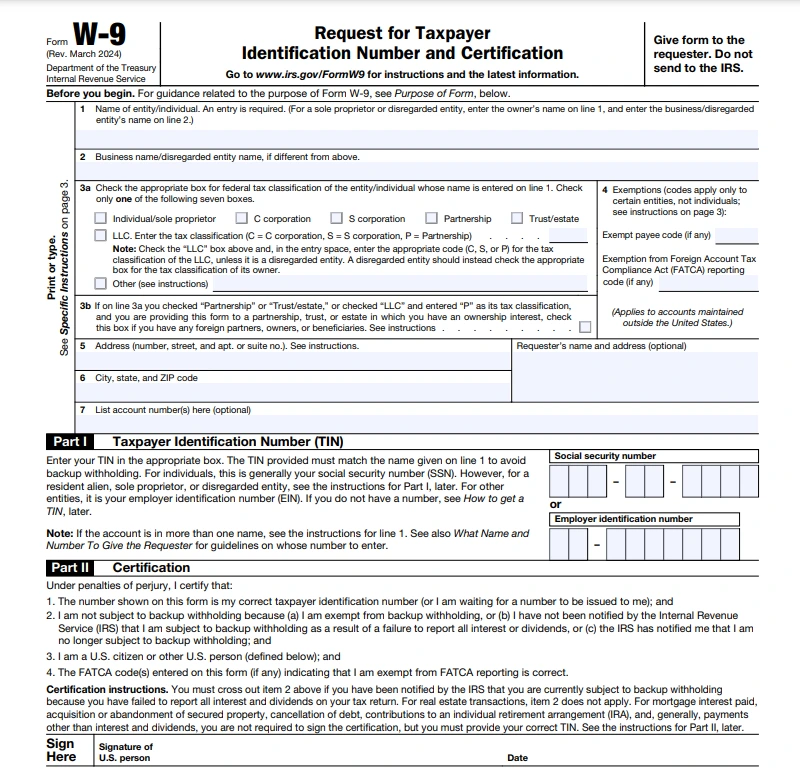

Step-by-Step Guide on How to Fill Out a W-9

Filling out your W-9 form correctly is important to avoid tax problems. In the next sections, we will clearly explain each part of the W-9 form. We will also provide simple steps on how to fill it out correctly.

1. Enter Your Full Name

Write your full legal name as it appears on your tax return. This ensures the IRS has the correct information.

2. Business Name (If Applicable)

If you operate under a business name (like a DBA), enter that here. If not, just leave it blank.

3. Choose Your Tax Classification

Sole Proprietor/LLC: If you’re a one-person business, check this.

C Corporation: For businesses that are separate from their owners.

S Corporation: For pass-through corporations.

Partnership: For shared ownership businesses.

LLC: If you’re an LLC, pick this and specify how it’s taxed (C, S, or Partnership).

Other: For international entities or special cases.

4. Exemption (If Applicable)

Enter the exemption code here if you’re exempt from backup withholding or FATCA reporting. Most people will leave this blank.

5. Address

Enter your address where you want any tax forms sent (like your 1099).

6. Account Numbers (If Needed)

List them here if they asked for account numbers (e.g., a brokerage account). If you’re unsure, ask the requester.

Part I: Taxpayer Identification Number (TIN)

Put your Social Security Number (SSN) if you’re an individual. For a business, provide your Employer Identification Number (EIN). If you’re a resident alien without an SSN, use your Individual Taxpayer Identification Number (ITIN).

8. Part II: Certification – Sign and Date

Sign and date to certify that the information is accurate. This is a legal confirmation.

It is very important to provide the correct TIN and business type. Mistakes can lead to penalties or slow processing.

When you sign this part, you confirm that everything in the first sections is correct and complete.

Make sure you read the certification statements closely before you sign. These statements tell you that you should not have backup withholding unless you say otherwise. They also confirm that you are a U.S. citizen or a resident alien. Lastly, they state that you own the TIN you provided.

If you are unsure about the certification, ask a tax expert for help. This will help you follow the IRS rules correctly.

Download W9 for free

You can get a free W9 form from the official IRS website. This form is a PDF. You can print it or fill it out online easily.

When you download the form, remember to also get the instructions from the IRS. These instructions will help you know how to properly fill out every part of the form. They also answer common questions for different situations.

Form W9 Due Dates and Penalties

W-9 is not like other tax forms because it does not have a specific due date. You should fill it out and send it back to the person who requested it as soon as you can. When you return it quickly, it helps them manage your information and meet their tax reporting needs on time.

You could get in trouble if you do not provide a W-9 when asked or if the info is incorrect. Giving false information on purpose can also lead to penalties. These penalties might include a backup withholding of 24% on the payments made to you.

Special Considerations for Self-Employed Individuals

If you are self-employed, it’s important to know about the W-9 form. You may encounter it frequently in your work. As a self-employed person, you are an independent contractor for your clients. If they pay you $600 or more in a tax year, they need to collect your TIN using Form W-9.

Stay organized.

Keep all your W-9 forms in one spot.

You may need to show this form to several clients during the year.

If anything changes, like your address or business name, inform your clients immediately.

After that, provide them with an updated W-9.

Common Mistakes to Avoid When Filling Out Form W9

W-9 is simple to complete, but it’s important to avoid common mistakes. These mistakes can lead to delays, fines, or identity theft. Here are some usual errors to watch for:

Incorrect TIN: Be sure that you have the correct TIN. This could be your SSN or EIN. A wrong number can lead to big issues with your tax records.

Mismatched Names: The name on your W-9 must match the name on your tax return. This is crucial for both people and businesses.

Incomplete Information: Fill out all the necessary sections on the form. This is important, even if some parts don’t seem significant to you.

Responding to Suspicious Requests: Be cautious about sharing your TIN with unknown people or if the request seems strange. It might be a scam.

By taking care and checking your details before you send it, you can lower the chance of errors. This will help make your tax reporting easier.

Other Common IRS Tax Forms

In addition to W-9, many other IRS tax forms are important for reporting taxes and following the rules. They help people keep track of different types of income, deductions, and credits. This way, both individuals and businesses can file their taxes correctly.

It is important to know what these forms are for. You need to understand what to do when you use them. This information will help you keep up with taxes. It will also help you avoid any penalties.

Form 1099-NEC

1099-NEC means “Nonemployee Compensation.” This form shows how much money independent workers, freelancers, and self-employed individuals earn. If you provided services for a client and made over $600 a year, you will likely receive a 1099-NEC.

The information on this form is important for the IRS. It shows how much money you have made by yourself. It also helps to check if you are paying your taxes correctly. You need to report this income on your tax return exactly as it is. If there is a difference between what you say and what the payer reports, the IRS may review your tax return more closely.

If you get a 1099-NEC, remember you must pay taxes on that income. This covers self-employment taxes and regular income taxes.

To know more, look up our article on 1099-NEC.

Form 1099-MISC

1099-MISC, known as “Miscellaneous Information,” is a standard form. It is used to report various types of income that do not come from regular jobs. This form includes payments such as rent, royalties, prizes, medical payments, and money made from fishing boats.

In real estate, 1099-MISC shows payments to agents or property managers. For instance, if you sell a property and pay an agent over $600 in commission, the agent will receive a 1099-MISC.

This form shows the mortgage interest you received. If you paid more than $600 in mortgage interest to a lender, they need to give you a 1099-MISC showing the total interest you paid.

Form W-4

W-4, known as the “Employee’s Withholding Certificate,” helps you calculate how much federal income tax is taken from your paycheck. You need to complete this when you start a new job or if something in your life changes that affects your filing status or dependents.

The information you provide on W-4 helps your employer figure out the right amounts for income tax, Social Security, and Medicare taxes to take from your paycheck. This withholding is very important. It ensures you pay your income tax during the year. By doing this, you can avoid a large tax bill when tax time comes.

Form W-2

W-2 is known as the “Wage and Tax Statement.” This form is important for your taxes. It shows a summary of how much you were paid and the taxes taken out during the last year. If you worked for several employers that year, you will receive a W-2 from each employer. You can expect to get them by January 31st.

Your employer uses the information you gave on Form W-4. They also need your social security number and the employer identification number (EIN). This helps them fill out your W-2 correctly. The W-2 shows your total earnings. It also shows how much income tax was taken out by the federal and state governments. You can see what you put into Social Security and Medicare too.

When you file your tax return, remember to check your W-2 details. This form shows your income and the taxes you’ve paid. It’s important to keep your W-2s safe. You may need them later, for example, when you apply for loans or social security benefits.

Conclusion

Understanding Form W-9 is key for tax compliance. If you are a freelancer, contractor, or running a business, you should know who needs to complete it and why. Follow the step-by-step guide to avoid errors and ensure proper submission. Stay aware of due dates, penalties, and withholding rules to prevent issues. Keep your information up to date and be cautious of any unfamiliar requests. If you have questions or need assistance, don’t hesitate to ask. Staying compliant will help you handle your taxes well.

Need Help with Tax Filing? Let ForMyTax Handle It!

Tax forms can be confusing, but you don’t have to do it alone. Whether you’re filing a W-9, dealing with 1099s, or needing assistance with your entire tax return, ForMyTax is here to help! Our expert team will guide you through the process, ensuring everything is done right and on time.

Contact us today for personalized support and stress-free tax filing!

Frequently Asked Questions

A Taxpayer Identification Number (TIN) is a unique number used by the IRS to track taxpayers. For individuals, it’s usually a Social Security Number (SSN), while businesses use an Employer Identification Number (EIN). Non-resident aliens or those ineligible for an SSN may use an Individual Taxpayer Identification Number (ITIN). It’s essential for tax filing and compliance.

Be cautious if you get a W-9 request from someone you don’t recognize. It’s important to confirm the legitimacy of the request before sharing any personal information, including your Taxpayer Identification Number (TIN). Always ensure you're dealing with a trusted entity, and never hesitate to ask questions if something feels off.

Yes, freelancers and independent contractors can benefit from submitting a W-9. By providing the requested taxpayer information, they avoid backup withholding on payments and ensure their income is reported accurately. This can simplify tax filing and prevent issues with the IRS.

It’s essential to update your W-9 whenever your information changes. This includes any updates to your name, address, business type, or taxpayer ID number. Keeping this information current ensures that clients and employers can report your income correctly and avoid tax reporting mistakes.

Backup withholding is when the IRS requires a payer to withhold a portion of payments (24%) due to issues with a taxpayer's reporting or identification. This often happens when someone fails to submit a valid W-9 form or has previous tax issues. It helps ensure that taxes are paid, even when there are reporting errors.

A W-9 form is used to provide your taxpayer identification details, such as your Social Security Number (SSN) or Employer Identification Number (EIN). Businesses or financial institutions typically request it to report payments made to you for tax purposes.

Businesses or financial institutions may ask you for a W-9 if they need your taxpayer identification details for reporting purposes, such as issuing a 1099 form or other tax documents. Providing this information helps them comply with IRS tax reporting requirements.

No, a W-9 and a 1099 serve different purposes. A W-9 is used to request and verify a taxpayer’s identification number, while a 1099 is used to report the income paid to the taxpayer for a specific year. The W-9 helps the payer correctly complete the 1099.

For businesses, a W-9 form collects taxpayer identification information, usually an Employer Identification Number (EIN), to ensure accurate reporting of payments made. This form is important for complying with IRS regulations for reporting business-related payments.

Providing a W-9 form is important if you receive payments for services rendered. It ensures that the business or payer can report your income correctly to the IRS and helps you avoid backup withholding, which could complicate your tax situation.

While you technically can refuse to provide a W-9, it's not advisable. If you don't submit the form, the payer may be required to withhold taxes from your payments, which could complicate your taxes and reduce your earnings.

Banks may request a W-9 to collect taxpayer identification details for reporting purposes. This includes interest earned from accounts or mortgage interest paid, which must be reported to the IRS for tax compliance.

The fillable Form W-9 can be downloaded from the official IRS website. You can complete it online and send it or print it out and fill it by hand.

W-9 forms are not submitted to the IRS and, hence, do not have a submission deadline. Share your form with the requester as soon as possible to avoid delays or issues with tax reporting.

If you have queries about the W-9 form, contact the entity requesting the form. You may also seek help from a tax professional or the IRS directly.

Read our blog about IRS Customer Service for more information.

Of course! Ensure you use a secure platform to protect your personal information.

Popular Blogs

1099-NEC Simplified: Filing Requirements & Tax Compliance for the Upcoming Season

1099-NEC Simplified: Filing Requirements & Tax Compliance for the Upcoming SeasonNavigating income taxes can be tricky. This is especially true…

Read More » Beginner’s Guide to Self-Directed IRA Rules and Regulations: Exploring Investment Options and Custodians

Beginner’s Guide to Self-Directed IRA Rules and Regulations: Exploring Investment Options and CustodiansAre you looking for ways to grow your retirement savings…

Read More » What Is APR: Types & Calculation Simplified

What Is APR: Types & Calculation SimplifiedWhen looking for a business loan, understanding APR (Annual Percentage Rate) is…

Read More » Contacting the IRS: To Receive Help, Call IRS Customer Service and Speak With an Agent

Contacting the IRS: To Receive Help, Call IRS Customer Service and Speak With an AgentNavigating the tax system can be overwhelming, but connecting with…

Read More » Unlocking the Importance of Accounting for Business Growth: Navigating Financial Success

Unlocking the Importance of Accounting for Business Growth: Navigating Financial SuccessAccounting is crucial for business success, influencing key decisions and…

Read More » Income Statement Explained: Meaning, Importance, and Examples for Your Business Success

Income Statement Explained: Meaning, Importance, and Examples for Your Business SuccessWondering how an income statement can help you track your…

Read More » Demystifying Liabilities in Financial Accounting: A Guide to Liabilities Definition, Categories, Examples, Ratios

Demystifying Liabilities in Financial Accounting: A Guide to Liabilities Definition, Categories, Examples, RatiosIn financial accounting, it is important to understand financial statements.…

Read More »

Related Blogs

Navigating IRS tax forms can be difficult. This is true if you don’t know much about the different types and what they

Navigating income taxes can be tricky. This is especially true for small business owners that hire independent contractors. Companies must report payments

Are you looking for ways to grow your retirement savings and increase your financial future? A Self-Directed IRA (SDIRA) might be the

When looking for a business loan, understanding APR (Annual Percentage Rate) is essential. It shows the full cost of borrowing, factoring in the interest

Navigating the tax system can be overwhelming, but connecting with IRS customer service can help clear up any confusion. Whether you need

Accounting is crucial for business success, influencing key decisions and driving profitability. Understanding the importance of accounting in organizations helps business owners

Wondering how an income statement can help you track your business’s financial health? This essential financial statement gives you a clear picture

In financial accounting, it is important to understand financial statements. A major part of this is about liabilities. They are the debts

In business, it is very important to know how your company is doing financially. Year-over-year (YOY) growth analysis is a key performance

Picture this: you’re sitting down to do your taxes, and you’ve got your Form W-2 in front of you. But then you

FORMYTAX.COM

Providing quick and personalized support is our mission. Our U.S. based support team is committed to providing excellent service in every time zone. We're always willing to help!

SUPPORT

- support@formytax.com

- (888) 808-4641

-

2400 Barranca Pky, Irvine, CA 92606

14341 Clark Avenue, Bellflower, CA 90706.