Extension Filling

- Home

- »

- Extension Filling

Entity Formation

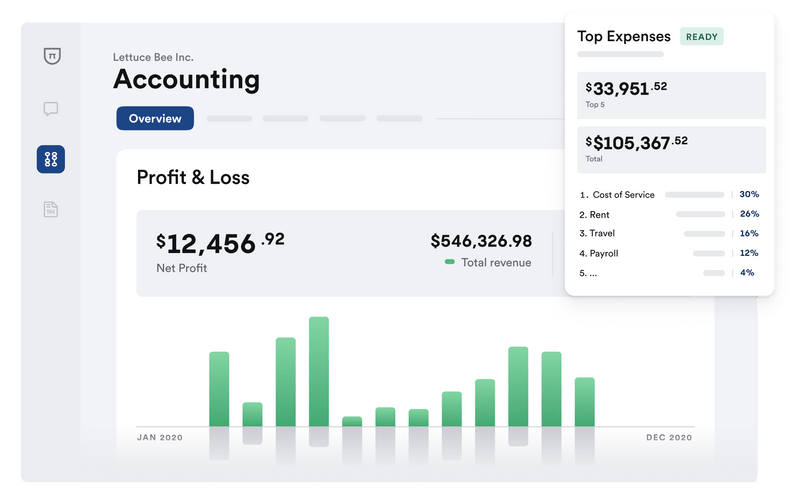

You want to start your own business but don’t know where and how to start? ForMyTax.Com provides a wide range of services to assist start-up businesses. From developing business plans and business entity selection to providing tax advice, our full-service approach will ensure your business is off to a flying start and you will be able to focus your energy on new business development.

Tax Preparation & Tax Filing

A tax extension gives taxpayers extra time to file their returns, allowing them to gather documents or consult with professionals. However, it doesn’t extend the payment deadline. Taxes owed must still be paid by the original due date to avoid penalties. Filing for an extension is easy and can often be done online, providing more time to ensure accurate tax filing.

Understanding Tax Extension Filing

Extension Filing refers to the process of requesting additional time to file your tax return beyond the standard deadline. In the United States, individuals can file Form 4868 with the IRS to receive an automatic six-month extension for submitting their federal income tax return. It’s important to note that while an extension grants more time to file, it does not extend the time to pay any taxes owed. Taxpayers are still required to estimate and pay their tax liability by the original deadline to avoid penalties and interest. Filing an extension is a useful option for those who need extra time to gather documents, address financial complexities, or seek professional assistance. Ensuring timely extension filing helps prevent unnecessary fines and ensures a more accurate tax return submission.

ForMytax.Com offers IRS Representation for clients who need help to get out if these jams. Other IRS Problems to which we can offer solutions –

1. Automatic Extension

2. Estimated Tax Payments

3. Avoiding Penalties

4. Estimated Tax Payments

if you are not able to file your federal/state individual income tax return by the due date, you may be able to get an automatic 6-month extension of time to file. FormyTax can help you file your extension for FREE regardless of whether you file your tax returns through us or not. Please be aware that an extension of time to file your reture does not grant you any extension of time to pay your tax liability.