US Tax Return Filing

- Home

- »

- US Tax Return Filing

Comprehensive US Tax Filing Services

Comprehensive US Tax Filing Services designed to provide you with a hassle-free and accurate tax experience. Our team of experienced professionals ensures that every detail is handled, from maximizing deductions to meeting all deadlines, while keeping you fully compliant with the latest tax laws. Whether you're filing as an individual or a business, we offer personalized solutions to make the process smooth and stress-free, giving you confidence in your tax filings and peace of mind throughout the year.

ForMytax.com services include:

- Tax Preparation & Tax Filing

- Strategic Tax Advisory and Planning services

- IRS Representation

Tax Preparation & Tax Filing

Also known as a sole trader, or simply proprietorship. Owned and run by one individual and where there is no legal distinction between the owner and the business. They are inexpensive to form, easy to dissolve and generally have no tax aspects, since profits and losses of the business are simply part of the owner’s personal income and the company is disregarded for tax purposes all profits and all losses accrue to the owner. All assets of the business are owned by the proprietor and all debts of the business are the proprietors.

Strategic tax Advisory and Planning services

Our qualified and experienced tax professionals will understand your requirements, analyze your situation, and provide strategic tax advisory and planning services. We offer tax planning in the following areas –

- Itemized v/s Standard deduction

- Tax planning for Expats (Work Visa holders) in the US

- Tax Planning for Student & Professional Visa Holders

- Non-Resident and Offshore Tax Planning

- Stock options (ESOP) / Stock purchase plans (ESPP) / Restricted Stock Units (RSUs) tax planning

- Investments into retirement plans 401K, IRA, SEP IRA, Solo 401K tax planning services

- Gift Planning strategies

- Creation of 501(1)(c) corporations and Private Operating Foundations

- Strategic Global incorporations, Transfer pricing arrangements & Advance pricing agreements

- Representation before the IRS

We charge our clients a straight fee for the scope of work rendered. Unlike other service providers, we don’t charge our clients on a percentage or contingent basis. Such practices are proven illegal and unethical in the eyes of the law.

ForMytax.Com offers IRS Representation for clients who need help to get out if these jams. Other IRS Problems to which we can offer solutions –

1. Assistance on filing your previous year’s tax returns

2. Discussions with IRS and payment of back taxes

3. Any other communication you want us to do with IRS on your behalf.

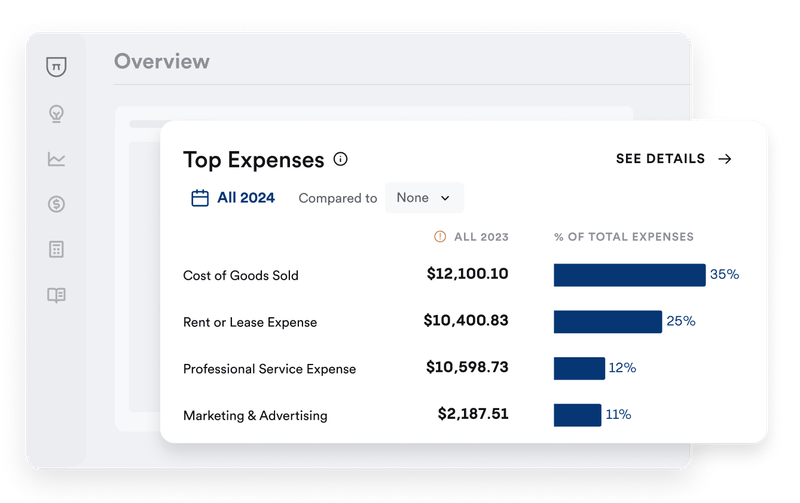

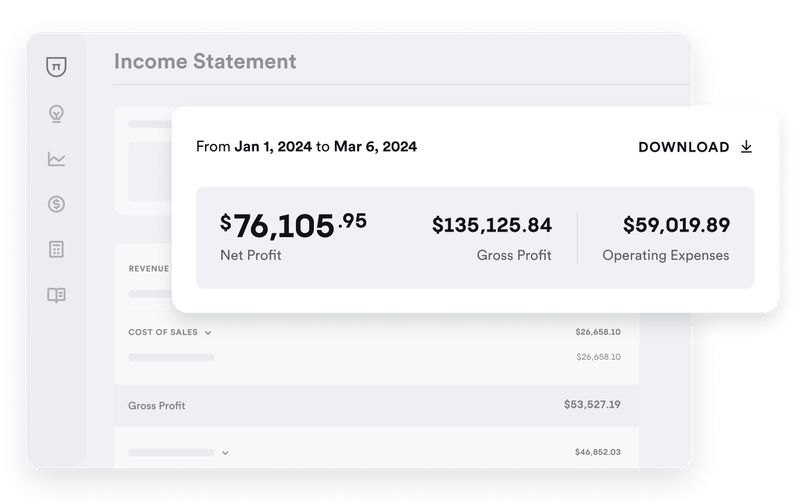

Income statement

Track where your money comes from, where it goes, and how profitable you are.

Balance sheet

View your assets, liabilities, and equity to future-proof your business.

In the previous year, a staggering number of over 164 million individual income tax returns were filed by taxpayers. Out of this massive pool, the Internal Revenue Service (IRS) conducted audits on 626,204 returns, seeking to ensure compliance. Interestingly, 93,595 were deemed full regular audits, while an overwhelming majority of 532,609 were correspondence audits, reflecting the evolving methods employed by the IRS. It’s remarkable that over 600,000 individuals found themselves in a position where they eagerly sought tax advice to navigate this challenging situation. And the need for such guidance persists year after year, illustrating the ongoing demand for expert assistance in the complex realm of taxation.… Every Year!